Email us: prashantlic93p@gmail.com

Mob: +91-950-365-2784

|

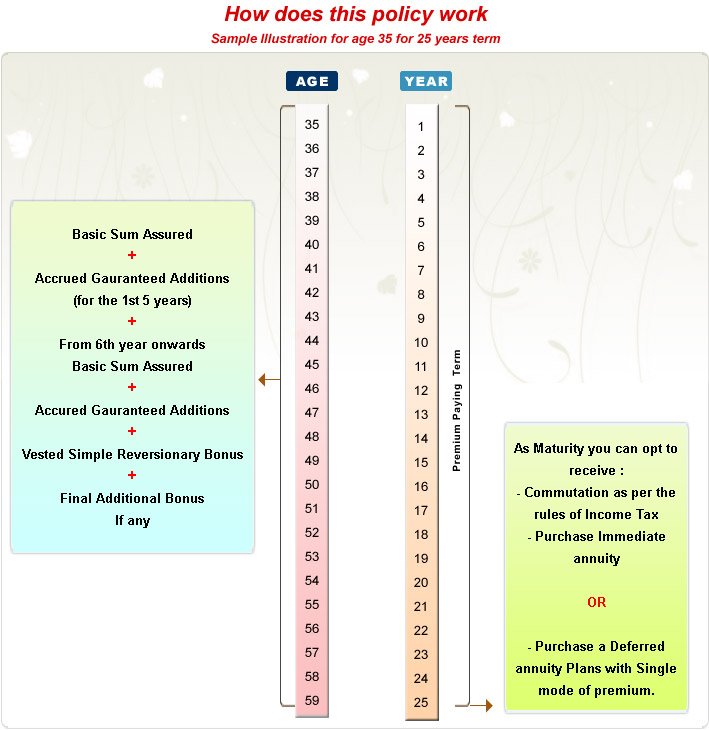

- LIC's New Jeevan Nidhi is a conventional with profits pension plan.

- Life Cover :

- Death during first five policy years :

Provided the policy is in full force, Basic Sum Assured along with accrued Guaranteed

Addition shall be paid as lump sum or in the form of an annuity or partly in lump

sum and balance in the form of an annuity to the nominee/ legal heir at the then

prevailing immediate annuity rates.

- Death after first five policy years :

Provided the policy is in full force, Basic Sum Assured along with accrued Guaranteed

Addition, Vested Simple Reversionary Bonuses and Final Additional Bonus, if any,shall

be paid as lump sum or in the form of an annuity or partly in lump sum and balance

in the form of an annuity to the nominee/legal heir at the then prevailing immediate

annuity rates.

- Benefit on vesting :

Provided the policy is in full force, on vesting, an amount equal to the Basic Sum

Assured along with accrued Guaranteed Additions, Vested Simple Reversionary Bonuses

And final Additional Bonus,if any shall be made available to the Life Assured.

- Option available to Life Assured for utilization of the benefit amount :

The following options shall be available to the Life Assured for utilization of

the benefit amount on vesting/ surrender.

- To purchase an immediate Annuity :

The Life Assured shall have a choice to commute the amount available on vesting/

surrender to the extent allowed under Income Tax Act. The entire amount available

on vesting/ surrender or the balance amount after communication, as the case may

be, shall be utilized to purchase immediate annuity at the then prevailing annuity

rates. Communication shall only be allowed provided the balance amount is insufficient

to purchase a minimum amount of annuity as per the provisions of section 4 of Insurance

Act, 1938.

In case the total benefit amount is sufficient to purchase the minimum amount of

annuity, then the said amount shall be paid as a lump sum to the Life Assured.

OR

- To purchase a new single premium deferred pension product from LIC :

Under this option the entire proceeds available on vesting/ surrender shall be utilized

to purchase a new single premium deferred pension product provided the policy holder

satisfies the eligibility criteria for purchasing single premium deferred pension

product.

The Life Assured will have to intimate his/her intention on to go for a particular

option available on the date of vesting at least six months prior to the date of

vesting or at the time of surrender.

|

|

Eligibility Criteria

|

|

|

Min

|

Max.

|

|

Age

|

20

|

60 for Single Premium

58 for Regular Premium

|

|

Term

|

5 - Single Premium

7 – Regular Premium

|

35

|

|

Sum

|

Rs. 150000 for single Premium

Rs. 100000 for Regular Premium

|

No limit

|

|

Premium Modes

|

Yearly, Half Yearly, Quarterly, Monthly

|

|

|